Health is Wealth, True that! But both are equally important for a satisfactory life. Wouldn’t you agree, Doctor? Here are 4 facts as a food for thought that can change the way you think about and plan your finances.

You have worked so hard to acquire the knowledge and then put it into practice. Over a period, this knowledge and practice will surely transform into invaluable experience which will thereby help save a million lives.

Dear Doctor,

This is an extraordinary life lived well with the satisfaction in your heart that you helped to cure someone in time and gave life to many. It’s priceless. Having said that, you devote most of your life in the wellbeing of others, sacrificing time and much more with regards to your family. Hence, we thought it would be a great idea to at least nudge you to look into your financial wellbeing for the benefit of you and your family.

Financial Planning as a subject is as vast as the medical field. Nonetheless, we have reduced it to some very critical facts and thoughts that can change the way you think about money and financial planning. We will first explain some important terms and then put it all together which will change your perspective of how to plan your finances. So, here we go. We will start with the premise that every individual or family is different and has different life goals.

To meet these goals, it is essential that every individual

➢ considers their income and expenses and

➢ do something with what is left after covering those expenses in a disciplined manner that can help you achieve your financial objectives.

The next question that comes to mind is ‘But why? I can just keep what is left after expenses in my bank account and spend it when necessary. Why should I do anything else when I will have income coming in for many years into the future that can take care of expenses as time goes?’

Here are the facts that challenges that logic:

INFLATION: ‘Fancy word. I have read it in newspapers along with other words like GDP, Economic growth, Recession etc.’, you say. But what’s that? Let me put it simply here. Inflation simply means that whatever you need for living on an everyday basis will increase in price over a period. Be it the price of Onions, Tomatoes, Potatoes, Petrol, Diesel, House, Clothing, anything that you can think of. The inflation for your family will be different from the inflation for other family as the increase in prices of different commodities will differ at each point in time. For example, if you drive a car and petrol prices go up from 80 INR to 90 INR. That’s 10 INR/ Litre more expensive petrol for you or in terms of percentage, the inflation in your monthly budget for Petrol is 12.5%. But someone who uses public transport or a cycle for that matter, may not be affected by inflation in petrol as much as it affected your monthly expenses. So, inflation for your family as an aggregate is the overall increase in expenses of your household just because of change in the prices of commodities that you use. I believe this term is now clear to you. For the sake of simplicity, we can just assume inflation as an aggregate as measured by the Government of India using the CPI Index (Consumer Price Index). Over the past 20 years, this has varied anywhere between 2.23% (2016) to 14.97% (2009).2 Currently, it’s around 7% and we can very well consider this as the average expected inflation over the next two or three decades. Ok. I get it. Prices are going to increase by an average of 7% every year, so what next?

INTEREST RATES: As the legendary investor Warren Buffett once explained it, ‘Interest rates are to asset prices as gravity is to apple. They power everything in the economic universe.’ (2013).2 Let me explain this. All countries have reserves banks which make decisions on what should be the short term and long-term interest rates in a country. India has RBI or the Reserve Bank of India. Similarly, US has the US Fed or The Federal Reserve. Interest rates in one country affect another and affect the currency rates. When interest rates are lower, borrowers who can borrow more will borrow. For example, if tomorrow your bank tells you that you only must pay 1% interest on your home loans which pretty much reduces the overall EMI on your loan, will you borrow? We believe the answer would be a straight YES!!!! Imagine a world where the bank says, I will give you money at 0.5% variable interest rates, do what you want with it. Go buy homes, buy businesses at any valuation out of thin air. Now, while the bank made you this offer, the inflation at that point in time was probably 1%. Imagine the inflation spikes to 8% or 9% because of some war in Europe between Russia and Ukraine. Boom!!! Bank says ‘Well, Inflation is 8%, so interest rates too are 8% now from 0.5%’ That’s a huge change. It almost triples your EMI, roughly 245% increase in the EMI. Imagine entire country taking cheap loans, buying multiple houses thinking they can afford the EMI now and their income will increase in the future. But 3 times the EMI, now we have a problem. The number of people who cannot afford this, start defaulting on their loans. Banks auction properties at lower rates and the housing market collapses. Banks too lost money, so they start firing people and they start selling every stock, real estate or any other investment they have to get liquidity. So, prices of assets have fallen as interest rates have increased. This is gravity and this is what happened in the US in 2008.3

Between all this, in India, your bank gives you 2.7% to 3% interest rate on the money that you have in your savings account while inflation is near 7%. So basically, you are losing 4% per year. And yes, you must pay tax on the interest above 10,000 INR that you get in your bank account as well. Damn! That’s cruel. Ok. I am losing money in savings account. Then what do I do then? Well, there are 2 parts to answer this question. Some money is necessary to be always kept in the bank account to cover any contingencies or any emergency that may arise. A good rule of thumb is 6 months of expenses to be kept in a savings account. Now, second part of the question arises if you have more money in the bank than what is required for an emergency. What do I do then?

INVEST: The third fun fact which opens the pandora’s box. ‘What is investing? Why to invest? Where to invest? Fixed Deposits, Mutual Funds & SIP, Index Funds, Stocks, Real Estate, Insurance, ULIP, Gold, Cryptocurrencies, NFTs? How much to invest and where? Let’s take these questions one by one. But before that let’s promise ourselves one thing and that is, ‘I will not invest in anything that I don’t understand.’ You may not understand the importance of this sentence now. But over a period of time, seasoned investors have always abided by this principle of ‘Invest in what you know and refrain from investing in what you don’t know’ and you will have to realize it too. Rather, learn now. Let us start with Fixed Deposits and use it as a reference point to understand Mutual Funds, SIPs and Stocks. Real Estate, Gold, Cryptos and NFTs we will deal with it separately.

➢ Fixed Deposits, its pretty straightforward. You invest 1,00,000 INR at 7% interest. You get 7000 INR paid annually to your account till the time it matures or you redeem. If you divide this Principal amount by the Interest, you get 1,00,000 / 7,000 = 14.28 times. So, when you buy a FD, you are basically paying 14.28 times a constant earning yield over the period of the FD. (Calculate this based on the interest rate offered by your bank) Focus on the word ‘constant earning yield’.

➢ Stocks, Mutual Funds, SIPs, Index Funds and Real Estate, this ‘constant’ becomes ‘growing’. How? Stocks are basically certificates of part ownership in a business. Mutual Funds are a portfolio of many such stocks put together. Similarly Index Funds are Mutual Funds which replicate the national indices, i.e., NIFTY and Sensex and other such indices. SIPs or Systematic Investment Plans is a concept of investing a fixed amount in Mutual Funds every month irrespective of the level of the market. So, coming back to the question of what makes the constant earning yield into growing earning yield? Stocks, Mutual Funds and Real Estate meet something called as a ‘double barrel test’. This test applies to any asset to see if it is an investment or a speculative asset. Double Barrel indicates that these assets have two components attached to it, price appreciation and income.4 Stocks and Mutual Fund units appreciate in price over a long period of time if the underlying business or portfolio of businesses increase their revenues and profits over this period. They also provide income in the form of dividend which is portion of the profits given back to the shareholders or unit holders while the remaining profits are reinvested by the owners of these businesses back into the business in order to grow the business. This reinvestment of profits if done carefully, leads to increase in revenues and profits. As profits rise, so does the dividend for the shareholders. What happens to the price of the stock on a given day or in a month or in a year is almost uncertain. However, over long period of time, generally over a 10-year period they reflect business reality accurately. If the business has done well, the stock will do well and the mutual funds which own many such businesses in their portfolio will do well as well. The same logic applies to Real Estate as well. Over a period of time as population increases, the prices of commodities required to build houses and apartment increases due to inflation, it creates more demand than the supply for real estate. At the same time, people who cannot afford to purchase real estate, rent the property from the owners which leads to income in the form of rent. This rent too increases over a period of time thereby becoming a growing earning yield. However, as compared to stocks or Mutual Funds, Real Estate is less liquid and it may take time to sell the asset at an appropriate value at an appropriate time. Hence, it is always recommended that investment in stocks, mutual funds, SIPs or Real Estate should be done for long term objectives or life goals like retirement planning, children’s education and marriage or any such long-term goals. Considering that you are a passive investor with little knowledge

of how to pick stocks, Mutual Funds and SIPs are the recommended pathways to invest in the stock markets. One more point to note here is what not to do when investing in Mutual Funds. It is human nature to look at recent returns and then invest in the best performing mutual funds. This is called recency effect. This should be completely avoided. Also, investing in sectoral funds or Mutual funds which typically represent a sector like Infrastructure Fund, IT Fund, Metals Fund etc should be avoided, especially if they have performed well in the past 2 to 3 years. This is because by the time you invest after such outperformance, the rally in that sector has already played out and valuations have turned expensive. Rather invest in Mutual Funds with a very long term known track record of more than 5 to 10 years where the average returns have been more than 12%. You can also simply start an SIP into a low-cost NIFTY Index Fund without worrying about the volatility of the market. This is likely to yield much better returns over longer periods as has been shown in the historic performance of the NIFTY and Sensex indices. As the country will grow, so will the index and along with that your wealth as well. As the saying goes, ‘Time IN the markets is more important than TIMING the market.’5

➢ As regards asset classes like cryptocurrencies, NFTs etc. these are completely speculative bets with no underlying assets that may produce something out of it. It purely depends on what the next person who is buying is willing to pay for it. In financial terminology this is known as the ‘Greater Fool Theory’ where the price of such speculative bets keeps on increasing till the time there is someone who is willing to pay more for these. From time to time in history such things have popped up and collapsed as well. For instance, the Tulip Mania of 1637, the dotcom boom & collapse of little-known internet companies in early 2000 etc.6 As a doctor, we believe, these things are best avoided.

➢ Coming to the subject of Gold as an investment class, in India this has more emotional value in terms of jewellery for men and women as against an asset that will produce any value. How much of gold you buy depends upon your personal capacity. But in the hierarchy of investment returns gold will fetch much less returns than Stocks, Mutual Funds and Real Estate.

Ok. Now we know about different asset classes and what it entails in terms of investing. But how much to invest in which asset class?

Here comes the fourth fun fact and the most important one which will clarify the question of how much to invest where:

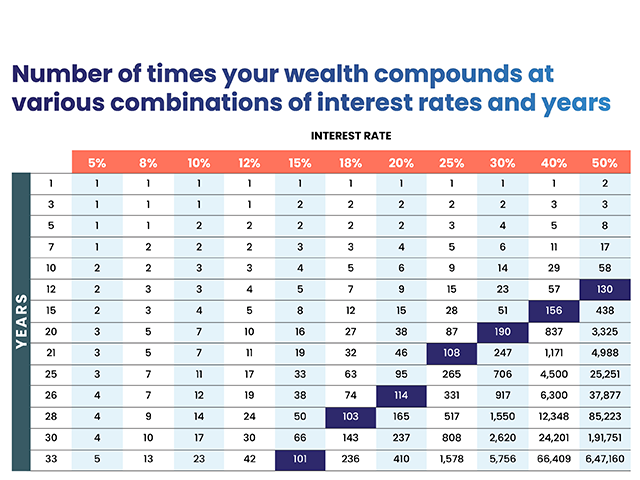

COMPOUNDING. The great Albert Einstein once said, “Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn't … pays it.”7 The best thing about money is that it works when you are sleeping. It works for you 24/7. Hence the saying goes, “Money Never Sleeps”. But the answer to how does it work for you lies in the understanding of COMPOUNDING effects or generally known as CAGR (Compounded Annual Growth Rate) in financial terminology. The only skill required and the most important one, which is rarely present in the human species who are always running behind the new, is, patience. Let me take the liberty to explain with an example and a chart of how compounding works over short and long periods. I bet you will start appreciating even a 1% difference in returns after going through this illustration. In the below table simply look at the difference in 10%, 12% and 15% interest rates at 30 years. 1 INR invested at 10% becomes 17 INR, the same becomes 30 INR at 12% and becomes 66 INR at 15%. A small 2% to 3% difference can have huge difference in the wealth accumulated over a 30-year period which is generally considered to be one’s career.

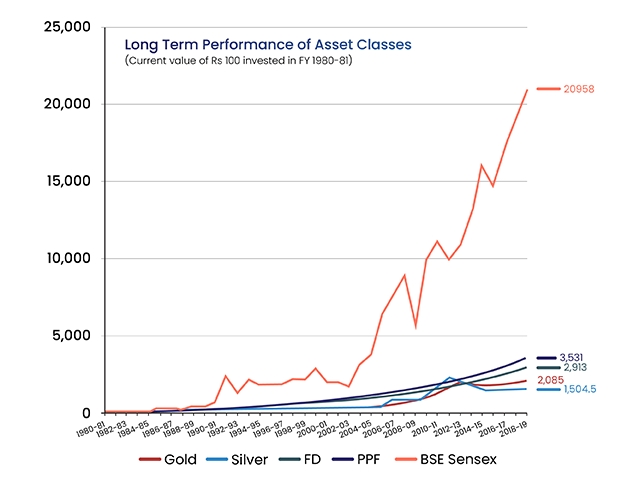

Let’s look at one more chart that can give us some indication of what the composition of our portfolio should be.

As you can see, over a 38 years period, Sensex or Stocks have given way higher returns than any other asset class like, Gold, Silver, FD and PPF. Real Estate as an asset class as compared to stocks is equally attractive, but less liquid. It also depends on the location in the country and hence it is hard to classify it based on returns as they would differ in different parts of India based on development and population increase in that location. But we can certainly establish the hierarchy in investment planning as per below:

To sum it all up, we come to the last part of financial planning:

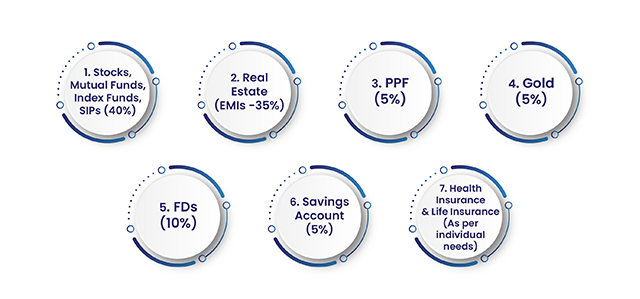

PORTFOLIO ALLOCATION. This is a very subjective matter and there is no rule of thumb to be followed. It depends on the risk appetite of the individual. Nonetheless, from the above historic results and looking at the effects of compounding, we can establish the following general financial plan which an individual can adjust based on their own preferences and as a percentage of their disposable income (Income left after monthly expenses)

Please note that the allocation to stocks and real estate is more for maximizing returns. The investments in PPF are to get stable returns every year. Gold generally is suggested to be less as jewellery purchased from time to time. Fixed Deposits and Savings Account are more from the perspective of emergency funds required at any given point in time. Health Insurance and Life Insurance should be a part of the portfolio as a safeguard for medical emergencies or in case of death.

Well, this sums up how you can start thinking of your finances taking into consideration the effects of inflation, interest rates, compounding, the safety nets required and the different asset classes available along with their historic returns. It is difficult to get too much covered but we have certainly touched upon the important factors that will determine your financial wellbeing and help you reassess your financial plan.

References

1. India: Inflation rate from 1987 to 2027 (https://www.statista.com/statistics/271322/inflation-rate-in-india/)

2. Adapted from: https://markets.businessinsider.com/news/stocks/warren-buffett-federal-reserve-interest-rates-gravity-asset-prices-valuation-2022-1

3. Adapted from: https://www.federalreservehistory.org/essays/great-recession-and-its-aftermath

4. Adapted from: https://fortune.com/2012/02/09/warren-buffett-why-stocks-beat-gold-and-bonds/

5. Adapted from: https://financebuzz.com/time-in-market-matters#:~:text=Time%20in%20the%20market%20means%20staying%20invested%20for%20the%20long,selling%20any%20of%20their%20assets.

6. Adapted from: https://www.pbs.org/wgbh/pages/frontline/shows/dotcon/historical/bubbles.html#:~:text=Here%20are%20five%20examples%20of,Bubble%20Economy%22%20of%20the%201980s.

7. Adapted from: https://www.ifec.org.hk/web/en/blog/2021/05/eight-wonder-compound-interest.page#:~:text=Albert%20Einstein%20once%20said%20%E2%80%9CCompound,of%20compound%20interest%20is%20unquestionable.

8. Adapted from: https://www.valueresearchonline.com/stories/50187/the-power-of-compounding/

9. Adapted from: https://scripbox.com/blog/the-myth-and-reality-of-losing-money-in-equity-investing.amp